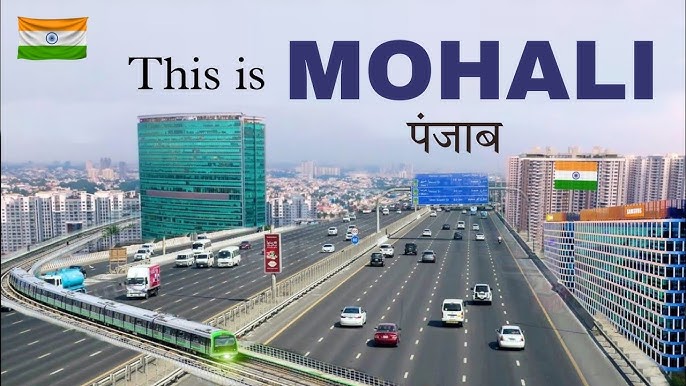

Mohali or Sahibzada Ajit Singh Nagar, a vibrant city next to Chandigarh offers great infrastructure growth, a strong IT sector and growing investor interest and has emerged as a real estate powerhouse in the last ten years. Like any hot market, though, it has its own set of risks and caveats. Let’s have a look into opportunities, challenges and essential tips for anyone looking at the Mohali 3 BHK Luxury Flats in Mohali property market.

1. Why Mohali’s Real Estate Is Booming: The Opportunities

a) Strategic Infrastructure Development

One of the biggest tailwinds for Mohali’s real estate market is the rapidly improving infrastructure. The city presently has major road expansions, highway connectivity and smart city initiatives in the works. Major connectivity corridors, such as PR-7 Airport Road, are under construction to connect Mohali to, among other locations, Aerocity, IT City and Chandigarh International Airport, among others, dramatically improving transportation and accessibility, allowing Mohali to become a more attractive option for both living and working. Additionally, there are public transport proposals being made to extend the metro and improve services.

b) Growing as an IT & Economic Hub

The city is fast becoming an important node in North India’s IT and services ecosystem. Major investments are underway: Infosys is adding capacity, a semiconductor and data centre project is underway; even the healthcare sector is scaling up with big hospital investments.

This is an inflow of business, meaning more professionals seeking high-quality housing. That demand is translating into real estate activity.

c) Varied Options in Real Estate

Mohali has a healthy mix of housing choices, quite unlike the more saturated or expensive markets. There’s affordable housing, mid‑segment apartments and luxury projects. The diversity means there’s something to suit the needs of different buyer segments: first‑time homebuyers, families, NRIsand investors. Luxury residential projects take centre-stage now in particular.

d) High Growth Potential

Mohali is becoming a high-return investment destination because of the convergence of infrastructure and economic drivers. Emerging areas like Aerocity, IT City and developing sectors (e.g., 66–80) are fast becoming hotspots. Experts in real estate estimate appreciation in these micro-markets on account of strong demand, inelastic supply in prime locations and improving connectivity.

2. Challenges in Mohali’s Real Estate Landscape

Although there is a large opportunity available, intelligent buyers and investors should realize that there will undoubtedly be several challenges to face.

a) Project Risk and Delays

Buyers/investors will likely experience delays associated with projects located within the area. There is also the possibility that unforeseen items will arise, such as construction, legal, or other challenges. If anything occurs during the process of possession, such as difficulty raising funds, bottlenecks in approving the project, etc., it could create uncertainty or decrease buyer confidence that they will receive a return on their investment.

b) Increasing Competition & Cost of Land

Acquisition costs are rising sharply as demand surges in prime corridors. Higher acquisition costs for developers can push property prices up, perhaps even beyond the reaches of buyers into mid-to-high-end projects.

c) Speculation Risk

Skeptical voices believe that the demand in Mohali is partly speculative and not organic. This channel of demand leads to artificial inflation of prices. A slowdown in speculative flows could lead to a risk of price correction.

d) Infrastructure Execution Risk

While plans for metro, smart city development and road expansion sound very promising, there is no guarantee of execution. Delays, cost overruns, or policy changes may derail some of the infrastructure projects, thereby damaging the projected uplift in property values.

3. How to Navigate Mohali’s Real Estate Market Smartly

a) Location

Concentrate on micro-markets that already have good infrastructure in place or it will be set to improve soon. For example, Aerocity, IT City or sectors adjacent to Airport Road are very appealing due to connectivity and long-term potential of growth.

b) RERA-approved projects

Give more priority to developers who are transparent, reliable and legally compliant. Projects approved by RERA provide more safety against fraud and delays.

c) Evaluate Builder Reputation & Track Record

Do some research on builders’ previous projects before committing. Are they timely, of good quality and without complaints? Checking these will reduce risk.

d) Don’t Over-leverage on Speculative Hype

While the potential for price appreciation is one of the major attractions, don’t bet on speculation alone: if you are buying to live in the property, make sure it will meet your lifestyle needs, not just your investment criteria.

e) Loan & Payment Planning

Work out your financing carefully-evaluate how much you can borrow, what EMI burden you can manage and whether the payment plan of the project fits in with your cash flows.

f) Visit the Site Personally

Nothing replaces a ground-level check. Visit the site, see the model flats, check connectivity, amenities and whether on-ground infrastructure is actually being built.

4. Mohali: A Real Estate Hub

If all goes well, Mohali could achieve a fine balance between the actual end-user demand for houses by families and professionals and the investors’ appetite, thereby reducing the likelihood of a bubble. Also, the thrust of future projects may be on green living, smart infrastructure and design with an eco-friendly bias, both due to regulatory push and buyer preference.

Conclusion

Mohali’s property market is experiencing record growth. There are abundant opportunities, supported by solid infrastructure momentum, robust IT and service economy, as well as a rising number of investors. However, there are also risk factors such as over-supply, speculative demand, delays in projects and regulatory conditions.

When combined with due diligence, Mohali 3 BHK Luxury Flats in Mohali property can be a rewarding avenue towards long-term appreciation and a respectable lifestyle. Buyers (if you choose to invest or occupy) will have a lot to think about, because the informed decision will be the key to moving through an active market with relative ease.